When it comes to investing, few names spark more debate than Warren Buffett and Cathie Wood. Buffett, the long-reigning king of value investing, is known for his fundamentals-first approach through Berkshire Hathaway. Cathie Wood, meanwhile, gained attention with her bold, tech-heavy bets via the ARK Innovation ETF (ARKK)—a fund that skyrocketed during the pandemic.

They represent two very different philosophies: Buffett plays the long game with steady compounding, while Wood aims for exponential returns by identifying the next big thing. But what happens when you compare them over a full decade?

Let’s break it down.

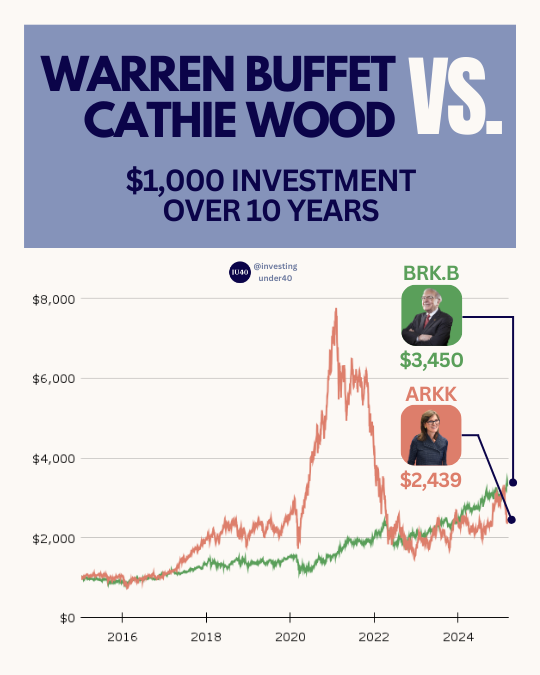

The Matchup: $1,000 Invested in 2015

Let’s say you had $1,000 to invest back in 2015. You decide to put it into one of two places:

- Berkshire Hathaway (BRK.B), managed by Buffett.

- ARK Innovation ETF (ARKK), managed by Wood.

Fast forward to 2025, and here’s what you’d have:

- Berkshire Hathaway (BRK.B): $3,450

- ARK Innovation ETF (ARKK): $2,439

Yes, Buffett wins—but not by as much as you might think.

ARKK’s Rise (and Fall)

ARKK’s story is a wild ride. Between 2020 and 2021, it was one of the hottest ETFs on Wall Street. Cathie Wood’s focus on disruptive innovation—think remote work, electric vehicles, and genomics—led to explosive gains. ARKK soared over 300%, with a $1,000 investment briefly topping $7,000.

But growth investing cuts both ways.

When the Fed began raising interest rates in 2022, speculative tech names lost their shine. With liquidity drying up and profits nowhere in sight, ARKK’s holdings plummeted—and so did the fund. Much of its gains evaporated as quickly as they appeared.

Tesla, one of ARKK’s largest positions, played a major role in both the surge and the collapse. Its recent market cap decline serves as a cautionary tale of how innovation alone doesn’t guarantee long-term returns.

This rollercoaster highlights a key investing truth: it’s not just about how high you climb—it’s how much you keep.

Buffett’s Steady Climb

Buffett, by contrast, has never been one to chase the hottest trends. But time and again, his disciplined approach proves durable.

Berkshire’s portfolio is filled with household names like Coca-Cola, Apple, and American Express—companies with strong balance sheets, reliable cash flow, and economic moats. While BRK.B didn’t experience the explosive growth that ARKK did, it also didn’t suffer the same collapse.

Over the same 10-year period, Buffett’s $1,000 quietly grew into $3,450—an annualized return of around 13%, with relatively low volatility.

Risk vs. Reward: A Tale of Two Styles

This comparison is about more than just numbers—it’s about philosophy.

Cathie Wood represents the growth-at-all-costs mindset. She and her team seek to identify breakthrough technologies and paradigm-shifting businesses early. That approach can generate incredible returns, but it also comes with high volatility and significant risk. You have to be willing to stomach big drawdowns.

Warren Buffett, meanwhile, embodies the slow-and-steady route. He looks for companies with intrinsic value and buys them at a discount. His returns may not be flashy in the short term, but over time, the compounding effect is powerful—and far more predictable.

What we see here is a perfect case study of risk management. Wood’s approach relies heavily on market conditions being favorable—especially low interest rates and investor appetite for risk. When those conditions changed, the strategy faltered. Buffett’s method, however, is more resilient to changing environments.

Lessons for Everyday Investors

So what can we learn from this 10-year showdown?

- Chasing fast growth can work—but it’s dangerous.

ARKK offered massive short-term gains, but most investors who bought in during the hype during the post-Covid era likely lost money. Timing matters when investing in high-growth vehicles. - Long-term durability beats short-term excitement.

BRK.B never made headlines for tripling overnight, but it steadily compounded over time. That consistency is invaluable, especially for long-term goals like retirement. - Market cycles matter.

ARKK thrived in an environment of low interest rates and speculative mania. But when the macro conditions changed, its weaknesses were exposed. A good strategy should hold up across different market regimes. - Volatility is not always worth it.

Higher risk doesn’t always mean higher reward. ARKK’s massive drawdowns erased much of its gains. On a risk-adjusted basis, Buffett’s strategy delivered superior returns.

So… Who Really Wins?

From a pure returns perspective, Buffett takes the win. That may surprise some, given ARKK’s reputation as a top performer in the 2020-2021 window.

But when you factor in risk, volatility, and the emotional toll of holding a highly volatile fund like ARKK, Buffett’s consistent compounding looks even more attractive.

That said, there’s value in both approaches. Wood’s conviction and willingness to invest in innovation are commendable. In fact, many of the companies she backed may still lead the next generation of economic growth.

The key is understanding your own risk tolerance and goals. Are you looking for moonshots? Or do you want steady, reliable growth? There’s no one-size-fits-all answer—but blending both strategies in a well-balanced portfolio might be the most practical solution.

Final Thoughts

The Buffett vs. Wood debate isn’t about picking sides. It’s about understanding the strengths and weaknesses of different investing styles.

Buffett’s playbook reminds us of the timeless power of fundamentals, discipline, and compounding. Wood’s strategy highlights the importance of innovation and future-forward thinking—but also the risks of going all-in on speculation.

As you plan your financial future, ask yourself if you would rather chase high growth, or stick with steady compounding.

Only you can answer that. Just make sure whatever path you choose, it aligns with your long-term plan and your comfort with risk.

Happy Investing!