Disclaimer: The information in this article is intended for informational purposes only and should not be taken as personal financial advice.

TQQQ Backtest: Key Takeaways

- A $1,000 investment into TQQQ in 1999 would be worth $2,456 today.

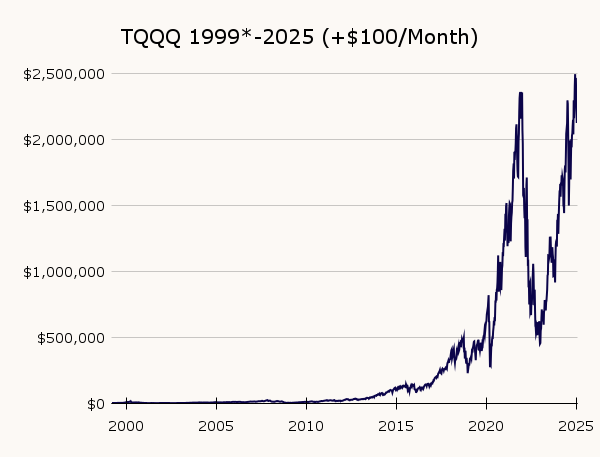

- With a $100 monthly dollar cost average, you would have $2,421,153 today.

- With a $500 monthly dollar cost average, you would have $12,095,937 today.

Investing in TQQQ Before the Dot-Com Bubble

Investing in TQQQ (3x leveraged QQQ) can be both thrilling and nerve-wracking. Since its inception in 2010, it has delivered an impressive 20,000% return. If you think a 200x return over the last 15 years is too good to be true, just take a look at the all-time chart below.

The consistent strength of the US stock market over the last 15 years has contributed significantly to the incredible returns of TQQQ. However, anyone remotely familiar with leveraged ETFs will know that recessions cause volatility decay and massive drops in value.

It just so happens that TQQQ has not existed long enough to experience the full effects of the early 2000s Dot-Com bubble or the 2008 Financial Crisis, so there is no chart to analyze. Because of this, I have always been curious about how TQQQ would have faired during these rough patches in the market.

Using historical data from QQQ, I created a simulation for how TQQQ would have performed if it had been available before the Dot-Com bubble in 1999. Additionally, I examined scenarios involving consistent dollar cost averaging (DCA) during that time.

The results may surprise you!

Methods for Backtesting TQQQ Before the Dot-Com Bubble

To estimate TQQQ’s performance before its inception in 2010, I used the following methodology and assumptions:

- Data Source: QQQ’s daily historical data was exported from Thinkorswim.

- Calculation Method: Assumed that TQQQ’s daily return rate is exactly 3x that of QQQ.

- Expense Ratio (ETF Fees): TQQQ’s current expense ratio (0.84%) was subtracted annually from the simulated value.

Please note that this simulation serves as a general representation and is not 100% accurate. As such, the results should be viewed as illustrative rather than definitive.

For those interested in the detailed plot and full data sheet, click here. Feedback on improving the data is always welcome through my contact page.

TQQQ Backtest: How It Would Have Performed Before the Dot-Com Bubble

TQQQ’s performance since its introduction in 2010 has been nothing short of remarkable. However, let’s examine how a $1,000 investment into TQQQ before the early 2000’s Dot-Com bubble would have fared over time:

Scenario 1: No Additional Money Added

Total Invested: $1,000 | Current Balance: $2,456 | Percent Gain: +146%

If you invested $1,000 in TQQQ in 1999 and never added another penny, your investment would be worth $2,456 today. While you would still be up overall, the journey was anything but smooth.

If you had bought TQQQ at the peak of the Dot-Com Bubble in March 2000, you would still be at a loss to this day.

During the 2008 financial crisis, your $1,000 investment would have plummeted by 99%, dropping to just $3. Yes, you read that right—only $3 remained from your original investment. But here’s the incredible part: from that rock-bottom low, your money would have grown back to $2,456, a nearly 82,000% return over 17 years.

Scenario 2: $100 Monthly Contributions

Total Invested: $31,100 | Current Balance: $2,421,153 | Percent Gain: +7,683%

By consistently contributing just $100 per month, your initial investment would have grown to $2,421,153 today! This shows the remarkable power of dollar cost averaging when paired with a high-growth, high-volatility investment like TQQQ.

Scenario 3: $500 Monthly Contributions

Total Invested: $156,500 | Current Balance: $12,095,937 | Percent Gain: +7,628%

With $500 monthly contributions, your portfolio would have reached an incredible $12,095,937.

There are two main lessons from this analysis:

- TQQQ is extremely volatile: It experiences massive drops during recessions but rebounds dramatically during bull markets. The 2000 Dot-Com Bubble and the 2008 Financial Crisis are prime examples of this volatility.

- Dollar cost averaging wins: Consistently investing over time proved to be the best strategy. By purchasing shares at lower prices during downturns, investors positioned themselves for exponential gains during bull market recoveries.

TQQQ vs. QQQ Before the Dot-Com Bubble: Which ETF Delivered Better Returns

Investors often compare QQQ (Nasdaq-100) with TQQQ, its leveraged counterpart that offers three times the daily return of the same index.

Let’s break down the performance of both funds using the same investment scenarios and timeframe of 1999-2025:

| Initial Investment (1999) | 1. No Additional Money (2025) | 2. $100 Monthly Contribution (2025) | 3. $500 Monthly Contribution (2025) | |

|---|---|---|---|---|

| QQQ | $1,000 | $10,372 | $277,058 | $1,343,800 |

| TQQQ | $1,000 | $2,456 | $2,421,153 | $12,095,937 |

Because TQQQ is a 3x leveraged ETF, it is subject to wild swings and volatility decay. As shown above, it vastly underperformed QQQ when no additional money was added to the original $1,000 investment in 1999.

The magic of TQQQ lies in regular contributions. Dollar cost averaging not only helped smooth out volatility, but it also let investors take advantage of the fund’s exponential growth during bull markets.

Is TQQQ a Good Investment for Long-Term Growth?

On paper, it’s so simple! Just throw a few hundred dollars at TQQQ every month for the next 20 years, and you’ll be a multi-millionaire, right?

Not necessarily. The harsh reality is that many investors struggle with emotional decisions during market crashes. Dollar cost averaging when your initial investment is down 99% is far more challenging than it appears on paper.

Additionally, past performance in the stock market does not guarantee future results. While the U.S. stock market has historically recovered from recessions in the past, there is no guarantee that stocks will go up forever.

Despite the risks…

I believe TQQQ can be a good long-term investment for a portion of your portfolio. Its underlying asset, QQQ, is a well-diversified ETF with a proven history of consistent growth. I have about a third of my portfolio allocated to TQQQ and keep cash on the sidelines for potential market downturns.

Conclusion: What the Dot-Com Bubble Taught Us About TQQQ Investing

If you had bought TQQQ before the Dot-Com Bubble, the journey would have been anything but smooth. A one-time investment saw extreme volatility and would have ended up underperforming QQQ as of 2025. On the other hand, dollar cost averaging into TQQQ would have turned your consistent contributions into millions of dollars.

TQQQ has the potential to be a great high-risk, high-reward opportunity. However, this investment requires you to have a certain threshold for the extreme volatility you will experience. Investors with the patience and discipline to follow through with a set investment plan are the most likely to succeed.

Happy investing!